Amara Capital Featured in the Los Angeles Times

Amara Capital was the subject of an article entitled “Paving the Way for Foreign Investment in Cambodia’s Growing Economy” in the Los …

Amara Capital was the subject of an article entitled “Paving the Way for Foreign Investment in Cambodia’s Growing Economy” in the Los …

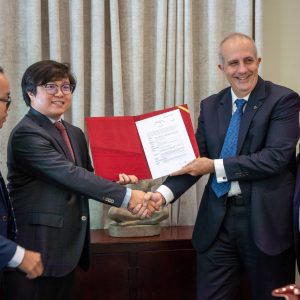

[Phnom Penh, June 30, 2023] – Amara Capital, a Cambodia-licensed fund management company, announced strategic growth investment in KFK Holdings, a leading …

Amara Capital, a Cambodia licensed fund management company, today announced that it has signed a definitive agreement to make a strategic growth …

#113C, Mao Tse Tung Boulevard, Tuol Svay Prey 1

Beoung Keng Kang, Phnom Penh, Cambodia

Officially licensed by the Securities and Exchange Regulator of Cambodia

Mr. Monivann brings with him more than 20 years of professional and business strategy experience, including more than 15 years of experience serving as a company director for various local and international companies. By starting his career as an auditor at Ernst &Young Cambodia, Mr. Monivann later became a Finance Director and Board of Director of Sepakor Angkor Co., Ltd. for 8 years and He spent 9 years serving as a Director & Chairman of the Board of Sathapana MFI and 6 years as a Director and Chairman of Audit Committee of Sathapana Bank Plc.

Currently, Mr. Monivann is an Independent Director and Head of the Audit Committee of Sihanoukville Autonomous Port (PAS), a listed company on the Cambodia Securities Exchange, a Chairman of Mega Leasing Plc., a financial leasing company, a Chairman of MVU Investment Plc., Vice Chairman of CIC Investment Plc., and Vice President of Siem Reap Oddar Meanchey Chamber of Commerce.

Mr. Monivann graduated with a Business Degree from Maharishi Vedic University (MVU), Cambodia, in 1997.

Mr. Socheat, a prominent CPA, has over 20 years of solid professional experience in accounting, finance, and investment. As the CEO of Laksmi Prime Investment, he effectively leverages his business management expertise as a board of directors at various institutions. His strategic input echoes across the boardrooms of key institutions, including a vice chairman of the Cambodia Chamber of Commerce, vice chair of the Government-Private Sector Working Group. and a board of directors of Mega Leasing Plc.

Before assuming his current roles, Mr. Socheat held pivotal positions at Morison Kak & Associés for 10 years and Leopard Capital, enriching his professional portfolio. His notable contributions to business associations in Cambodia, particularly as a chairman of the Cambodian Valuers and Estate Agents Association, underscore his industry leadership. His areas of expertise include investment and business analysis, corporate finance, asset management, financial modeling, financial due diligence, and accounting.

Mr. Socheat graduated with a Master of Science in Professional Accounting from the University of London (United Kingdom). He also holds an ACCA qualification from the United Kingdom and is a CPA Australia member.

Taihei brings more than 12 years of investment and entrepreneurial experiences. With a strong background in strategy and finance, he serves as a director at multiple companies across various industries including IT startup, hospitality and asset management in both Asia and North America. In Cambodia, he serves as a director at Nham24, the fastest growing and leading food delivery startup, Banhji, the award-winning inclusive fintech startup, and Amber International, the leading small luxury resort developer and operator. Prior to his current responsibilities, he was an investment professional in the private equity division at Norinchukin Bank, one of the largest institutional investors in Japan with more than USD 800 billion in asset.

Taihei holds a Bachelor’s Degree in Economic Development from University of California Berkeley and he is also a Certified IPO Professional and Certified M&A Specialist in Japan.

Chhayleang brings with him over 10 years of professional experience in property brokerage, valuation, management, consultancy, and development. Currently, he is the CEO of Pointer Property, a top real estate agency in Cambodia with over 100 sales agents. As a licensed real estate agent and a member of the Cambodian Valuers and Estate Agents Association, he has provided development consultation and sales and marketing support to renowned local and international property developers and led his teams to close deals worth over 100 million dollars. He is motivated by meeting new people and offering property advice. His vision is to see a world where people have access to accurate information and data so that they are empowered to make the right decisions when buying property.

Chhayleang holds a Bachelor’s Degree in Business Management from the University of Cambodia, and a Bachelor of English Literature from the Institute of Foreign Languages.

Mr. Shiraishi has over 18 years of professional experience in investing in Japanese and North American public companies. He is currently the Chairman of Laksmi Prime Investment Co., Ltd. and he has been the Director of several financial companies in Cambodia, including Bamboo Finance Plc., Trop Khnom Microfinance Plc., Mega Leasing Plc, since 2014. Prior to being involved with the business in Cambodia, he had been working for the investment division of Hikari Tsushin Inc., a company listed on the Tokyo Stock Exchange. Now he is the CEO of Snowball Capital Inc., a Japanese investment company.

Mr. Shiraishi holds a Bachelor’s Degree in Economics from Hitotsubashi University, Japan.

Mr. Yuki has been working in investment throughout his career. Started off in the investment team of a company listed on the Tokyo Stock Exchange, Hikari Tsushin Inc., focusing on the Japanese market. He then went to focus on M&A of software companies within Japan, in Constellation Software Japan Inc., a joint venture between Hikari Tsushin Inc. and Constellation Software Inc., listed on the Toronto Stock Exchange. He was a part of the team that conducted the first acquisition in Japan, Rescho Inc. which was a market leader in Electronic Medical Records for Psychiatric Hospitals. He has then moved on to Global Capital Management Inc., a family office, expanding the investment portfolio internationally as well as into real estate.

Yuki grew up in Singapore and went to further studies at International Christian University in Japan.

Chhoung possesses over a decade of extensive professional experience in the fields of finance, investment advisory, and private equity fund management. Currently serving as the Partner and Head of Investment at Amara Capital Plc, he plays a pivotal role in all aspects of debt and equity investment, ranging from deal origination to conducting thorough due diligence to executing deals and managing portfolios.

Prior to his current position, Chhoung excelled as an Investment Manager at a Cayman-based fund management firm, managing a USD 50-million fund with investment portfolios spanning across Cambodia, Laos, Myanmar, and Vietnam. Additionally, he has served on corporate board and acted as an investor for various enterprises in Cambodia. Demonstrating his expertise, Chhoung has contributed as both a buy-side and sell-side advisor, facilitating transactions with a cumulative value exceeding USD 100 million. Additionally, he possesses invaluable experience with the Cambodia Securities Exchange, having served as a listing and disclosure manager.

Chhoung’s academic qualification comprise a Master’s Degree in Economics with finance specialization from the Shanghai University of Finance and Economics, complemented by a Bachelor’s Degree in Accounting and English for Communication. Furthermore, he has earned certifications as a Certified Financial Modelling and Valuation Analyst and Certified Financial Planning & Wealth Management Professional from the Corporate Finance Institute.

Soung brings extensive research experience in the areas of personal finance, behavioral finance, and investment advisory. Prior to joining Amara Capital Plc, she contributed significantly to the publication “Digital Insights: Future of Cities” with her article “The Role of Fintech in Smart Cities,” which explored the transformative impact of financial technology on urban development and was published by KAS Cambodia. Soung also developed her expertise in financial content creation as a writer for Kakcent, a social platform focused on finance-related topics.

She holds a Bachelor’s Degree in Banking and Finance from Paragon International University in Cambodia and is a CFA Level 2 candidate.

Lideth brings over 15 years of extensive experience in finance, banking, and the Cambodian capital market. Before joining Amara Capital, Lideth devoted almost 10 years at the Cambodia Securities Exchange (CSX) holding the position of Director of the Listing Department where has played a significant role in shaping the Cambodian capital market landscape, showcasing a deep understanding of regulatory frameworks and exceptional leadership in the field. His role entails providing consultation to potential listed companies in various areas such as finance, taxation, operations, and corporate governance. He conducted comprehensive evaluations of their business operations, growth potential, and financial performance. His responsibilities encompassed finalizing eligibility assessments, valuations, and offering advice on alternative financing options. He also organized in-house training sessions to prepare companies for listing on the bourse. He devised strategies to revitalize capital markets and put forth novel listing product proposals. In addition, he spent 5 years as a credit analyst at Acleda Bank, one of the biggest banks in Cambodia.

Lideth holds a Master’s Degree in Finance degree from the National University of Management and a Bachelor’s Degree in English from Norton University.

Moninea joins Amara Capital as an experienced auditor at Grant Thornton Cambodia, where she developed expertise across a wide range of industries, including manufacturing, retail, and financial services. Her work spanned various business life cycles, from start-ups to established enterprises, allowing her to hone her skills in financial statements, internal controls, and accounting regulatory compliance. This diverse experience forms the foundation of her current role as an Investment Analyst at Amara Capital Plc.

She specializes in analyzing financial statements and providing data-driven recommendations, ensuring that each investment decision is supported by comprehensive financial analysis. Her keen ability to assess potential risks and opportunities enables her to make informed decisions that align with both client objectives and broader strategic goals.

Moninea holds a bachelor’s degree in accounting and finance from CamEd Business School in Cambodia and is a Certified Accounting Technician (CAT) from the United Kingdom. She is currently pursuing her ACCA qualification.

Before joining Amara Capital Plc, Anita gained extensive auditing experience at Grant Thornton (Cambodia) Limited, where she worked with a diverse range of clients, including financial institutions, commercial enterprises, and NGOs. Throughout her time there, she developed strong competencies in risk assessment, internal control reviews, and financial statement analysis. This role sharpened her ability to analyze data, identify discrepancies, and ensure the accuracy and completeness of financial information.

Her auditing background serves as a solid foundation for her current role as an Investment Analyst at Amara Capital Plc, where she leverages her analytical skills and expertise in financial statement analysis to evaluate investment opportunities, assess risks, and provide informed recommendations.

Anita holds a bachelor’s degree in accounting and finance from CamEd Business School in Cambodia and is a Certified Accounting Technician (CAT) from the United Kingdom. Notably, she achieved worldwide number 1 for the Foundation in Financial Management in her CAT exam. She is currently pursuing her ACCA qualification.